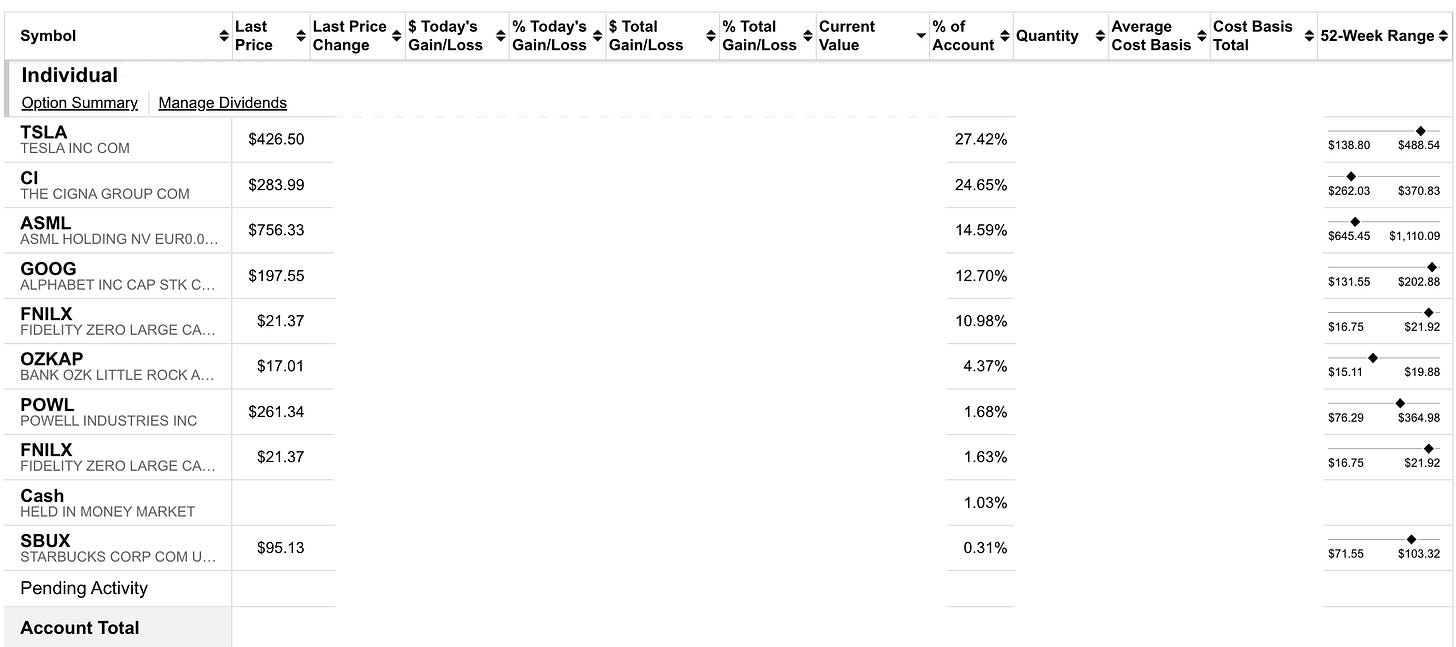

As the market has raced up to end 2024 and kick-off 2025 with another bang, here’s a quick update on my portfolio since the last one at the end of July 2024.

Tesla

Outlook: Trim/Exit

With Trump’s election in 2024 and the subsequent race-up in Tesla as a result, it now makes up the biggest share of the portfolio.

While the company continues to execute nicely in the automotive & (more-so) energy sector, the lofty valuation of the stock is definitely a concern.

I am planning on slowly trimming and exiting the position (some by end of this month and more in April) as the shares convert to long-term status.

Cigna

Outlook: Hold

With the execution of UnitedHealthcare’s CEO in December, stocks across the healthcare industry took a sharp hit due to uncertain future prospects and impact to business practices.

Cigna was no exception. That being said, I do believe Cigna is trading at the lower end of its range and will recover back to $330-350 range. The bigger pie of exposure being in commercial/private insurance vs government is a benefit.

ASML

Outlook: Accumulate

ASML holds a critical, monopolistic place in the semiconductor industry and the current multiples along with stock price are favorable.

Google

Outlook: Hold

Google has been a victim of negative news & sentiment as of late. However, over the past few months, the stock price has made a decent recovery. Despite that, it’s still fairly valued, especially from a multiples & free cash flow yield perspective.

I’m happy to hold this till $250.

FNILX

Outlook: Accumulate

Weekly index purchase for the long-term.

OZKAP

Outlook: Hold/Accumulate

This preferred share from Bank of Ozark serves as a fixed-income component to the overall portfolio, attempting to provide some stability while also generating decent income. At the current price of $17, that’s an attractive 6.7% yield.

I feel there are better buys at the moment (e.g. ASML) but if that wasn’t a case and you’d prefer to add an income type position, this is a great choice.

POWL

Outlook: Hold

I exited a substantial chunk of this position back in October when it raced up to $250. I still hold it in my Roth IRA and occasionally sell covered calls against the position. That has been a rollercoaster ride, for sure!

Cash

Cash makes up ~1% of the pie. I like to transfer cash & invest right away so this is not an accurate representation of the overall cash position.

Starbucks

Outlook: Hold

Starbucks continue to go through the struggle of falling sales. With the hiring of Brian Niccol, I’m optimistic that Starbucks can get back to its root and grow the business once again.

In the meantime, the goal is to generate enough dividends for an occasional coffee!

Conclusion

That wraps up this short update of the portfolio and looking forward to an eventful 2025. I’ll try to make these more frequent going forward.